1-800Accountant offers full-service accounting services, including tax preparation and advisory to small businesses. Online bookkeeping services are a hybrid of bookkeeping software and professional accounting. You get the benefit of the assistance of a pro bookkeeper with the flexibility of managing what you want to manage. While the use of the company’s proprietary software can work well for newly established businesses, it can be difficult to switch from this system over to another accounting software such as QuickBooks or Xero.

Can I do my own bookkeeping for my business?

- Proprietary bookkeeping software could make it difficult to switch to another provider in the future.

- “This is the opposite of intuitive communication that’s more free-flowing and may not get to a resolution within that scheduled time frame.

- And, out of all virtual bookkeeping services, Bench is the highest rated by users.

- Merritt Bookkeeping automates some of the most time-consuming bookkeeping tasks — for instance, reconciling accounts, balancing books, and updating financial reports — so you can focus on running your business.

- The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

- There are several key rules of bookkeeping to keep in mind, but one of the most important is regarding debits and credits.

- However, the hourly rate of $49 for add-on services is very affordable.

Bookkeeper360 integrates with third-party tools, such as Bill, Gusto, Stripe, Shopify, Xero, Brex, Square, Divvy and ADP. These integrations make it easy to track your bookkeeping and accounting data in one place. It also offers full-service bookkeeping, meaning that its team will do the bookkeeping for you. If you only need periodic help, pay as you go for $49 per month plus $125 per hour for support. Otherwise, monthly pricing starts at $399 and weekly pricing starts at $549 per month. If managing the financial aspects of your business is a headache, it may well be worth it to pay for a helping hand with bookkeeping and tax preparation.

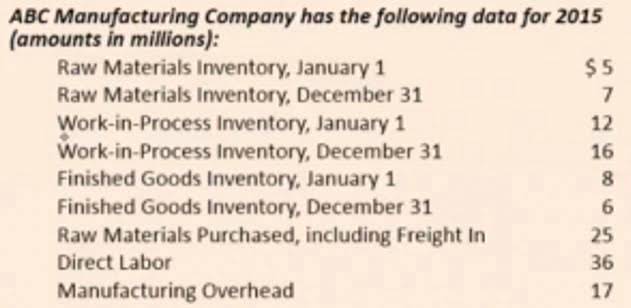

How to Read (and Analyze) Financial Statements

Thankful for all the tools provided, especially AI which did a great impact on my work. It also has a virtual assistant that reads and comprehends your entire business Bookkeeping for Chiropractors plan and answers any questions you have regarding your business plan. So, let’s head straight to our list of best AI virtual assistants for businesses in 2024. You may look for other product alternatives to find the best deal possible.

Does the assistant learn and improve over time?

While Wave Advisors provides payroll coaching, it doesn’t offer any customized services. Brainy Advisors and Bookkeeper360 are both good options if customized services are important to your business. We selected Merritt Bookkeeping as one of the best online bookkeeping services because it ranked high among users, with the best user review scores of all providers listed here. What’s more, it is praised for its ease of use and accessible customer service. Freelancers and startups that work remotely will appreciate the iOS mobile app that provides financial reporting functionality and real-time cash flow updates.

KPMG Spark is a fully online bookkeeping service that offers easy onboarding and integration with your bank. We’ve bookkeeping firms looked at dozens of companies offering bookkeeping services and narrowed it down to what we think will work best for small businesses. Each may offer slightly different services and features, so choose the one that best suits your business needs. If financial terms like income and expense, debits and credits, and balance sheet make you cringe, you probably aren’t alone. And unless you have the budget to hire an in-house accounting department, you might not know what your options are in terms of making sure your bookkeeping gets done properly and on time.

We use our own proprietary accounting software to complete your books. You won’t need any other software to work with Bench—we do everything within our easy-to-use platform. A year end package with everything you need to file comes standard with Bench. With our Bookkeeping & Tax plan, you get expert tax prep, filing, and year-round tax advisory support.

- We believe everyone should be able to make financial decisions with confidence.

- Susan Guillory is an intuitive business coach and content magic maker.

- If you’re looking for an intelligent virtual assistant to ensure everyone on your team knows everything about your organization and its next action steps—Parrot is the tool you need in your arsenal.

- The provider also took a hit in our personal bookkeeper category because it doesn’t provide a phone number to call, although you can request a callback.

- This allows us to automatically process large amounts of financial data instantly, and close your books faster and accurately.

- The provider doesn’t offer tax preparation and filing, so it took a hit in our tax category.

- Your bookkeeper has a portfolio of clients they’re working for, but they’re always available for questions or conversations about your finances.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy. As part of ongoing bookkeeping, your bookkeeper categorizes your transactions and reconciles your accounts each month. Get unlimited, year-round expert help as you prepare your business taxes and contribution margin file with confidence.